Australia's Fast & Flexible Business Loans

1st & 2nd Mortgages from $20k to $2m in 24 hours. No Cashflow or Financial Records Needed.

Featured In:

About Our Fast Business Loans

Whether you're a business owner, property developer, importer, self-employed tradie, or even a new business, we can help, as we lend to almost any business.

Our Lending Policy is Simple: If you have a business purpose for the loan, and sufficient equity in real estate, WE WILL FUND YOU in 24 hours!

Our Fast and Flexible Open Term Business Loan

We prepay the interest for the first 6 months, meaning you don't make any loan payments for 6 months. After 6 months, you just pay the interest each month for as long as you need the funds.

These 1st mortgage or 2nd mortgage business loans are perfect if a business owner needs funds ASAP, but is suffering from Payment Fatigue.

- Borrow from $20,000 to $2,000,000

- No Payments for the first 6 months

- Loan Terms from 1 month to as long as you like

- Loan term can be extended with no fees or penalties

- Loan can be repaid early and you save on interest

- You enjoy a loan with Full Flexibility

- No Cashflow Records or Financial Required

- Funding in 24 hours

We are Australia's Fastest & Most Flexible 1st & 2nd Mortgage Lender.

If you have sufficient equity in real estate, WE WILL FUND YOU within 24 hours.

Any Business Purpose - Any Industry - Anywhere in AU

We FUND Australia's Fastest

& Fully Flexible Business Loans, including

Caveat Loans

Bridging Loans

+ 1st and 2nd Mortgages

Funds in your account in 24 hours + No Payments for up to 6 months

- Borrow from $20,000 to $2,000,000

- Bad Credit Score & Loan Arrears? OK

- We don’t do Valuations

- Loan Terms from 1 month to as long as you like

- New Businesses OK

- No financials or cashflow records needed.

Why 10,000+ business owners have chosen a HomeSec 1st or 2nd Mortgage Business Loan.

A HomeSec Business Loan is..

Ultra Fast and Simple!

We can fund you within 24 hours from the time you apply. Everything is fast and simple.Simplicity!

We hardly require any paperwork, and we use the latest tech to streamline everything.Trusted

We have been lending to Aussie businesses for 20 years and are 100% about fairness, transparency, and ethical practices. Don't be fooled by bogus lenders and the fake low interest rates they use to lure you in. Only deal with a trusted private lender, and that lender is HomeSec.

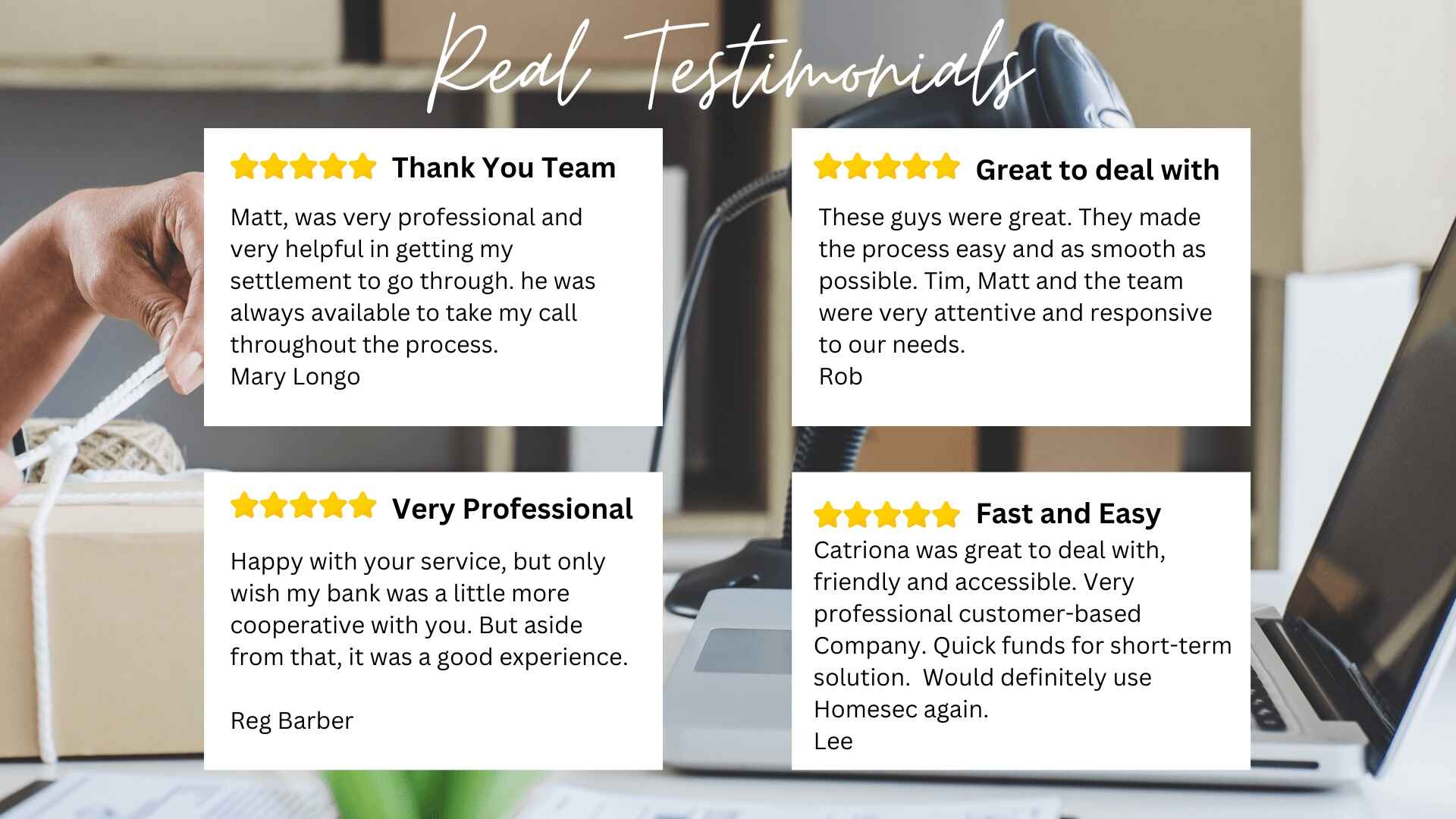

Our customers can't stop raving about the amazing HomeSec service

Business Funding in 24 hours

Fast 1st and 2nd Mortgages for ANY worthwhile business purpose.- We don t judge. We just find solutions

- Get from $20k to $2m BY TOMORROW

- Professional Service all the way

OUR PROCESS - How we fund business loans in 24 hours.

Apply Online

This takes all of 60 seconds to apply. We don't ask for any confidential or sensitive information, and WE DON'T DO ANY CREDIT CHECKS.Receive a Quick Call

A friendly and experienced HomeSec Credit Specialist will call to discuss your loan requirements. Conditional approval is usually given on the phone.Sign Letter of Offer

If conditionally approved, we will send you a Letter of Offer to digitally sign. This is a summary of the loan transparently outlines all of the costs.Final Checks

We then do our final assessment of your loan and organise your new loan agreements to be sent to your lawyer, where you will need to sign them.Signing Loan Agreement

We are all about transparency and full disclosure. That's why we ask all clients to get independent legal advice when signing their loan documents.Your Loan is Funded.

Once you have signed your loan agreement, and all documents are scanned and emailed to our lawyers, we fund you within 2 business hours.BREAKING NEWS – We now lend from $20,000 to $2,000,000!

Apply In 60 Seconds – Funds Available in 24 Hours

WE ARE Australia’s fastest and most trusted LENDER for fully flexible secured Business Loans. From a 1st or 2nd Mortgage, Business Bridging Loan, Caveat Loan, Equity Release Business Loan, as well as Interest Only 1st and 2nd Mortgage Loans. We are the actual lender, and we fund them all.

Our secured business loans have helped thousands of business owners across Australia. We look past adverse credit history and any other negative factors, and focus on funding our clients by the very next business day.

Easy Application Process

Apply online in just 60 seconds, and our team will assess your application and contact you within the hour (during business hours). Hardly any paperwork is required!

Funding in 24 hours

See how much you can borrow

Grow your Business with an Easy Business Loan from HomeSec

HomeSec Business Finance has been helping businesses for three decades by offering quick business loans in Australia. As one of the most reputable lenders in this field, we support all business owners through the ups and downs they experience while running their businesses. Our business loans are regarded as a lifesaver for business owners in a crisis, or business owners who have an unexpected opportunity, but need the business funding almost immediately.

Depending on your requirements and the purpose for which you will be using the funds, we can customise a HomeSec Business Loan to suit YOUR needs. HomeSec Private Business loans are excellent for funding urgent business opportunities, equipment purchases, and even paying overdue creditors. With out unique offer of NO PAYMENTS FOR 6 MONTHS, you can take care of the problem today and not have to pay a cent for 6 months.

Why is a HomeSec Business Loan so great?

Savvy business owners use us to immediately unlock the dormant equity in their real estate assets to urgently fund their business.

Assists with cash flow

Helps access the working capital to keep the business running smoothly.

Purchasing Inventory

Capital can be used to purchase new stock, equipment or tools.

Repaying outstanding debts

Refinance business debt into one easy and flexible business loan.

Paying for Overheads

Use your new business loan to help cover operating costs such as utilities, staff, and many other bills.

Is it easy to get a Business Loan with HomeSec?

Everything we do at HomeSec is designed to be fast and easy. Firstly, take 60 seconds to fill out all the details of our simple online application form. One of our friendly credit experts will contact you to quickly discuss your requirements, discuss the costs for the loan term you want, and answer any other questions you may have.

Transparency is everything. HomeSec is known as Australia’s Trusted Private Business Lender because we don’t beat around the bush and try and hide the true cost of the loan. We explain it all so you know everything there is to know about your new 1st mortgage or 2nd mortgage.

Our business loans require almost no documentation. We will just need a rates notice for the security property, a driver’s license or passport, and a copy of a recent mortgage statement if you have an existing 1st mortgage on the security property.

We can conditionally approve your loan over the phone, and if everything is okay, we will issue a Letter of Offer within 2 business hours. Once the remaining checks are done, we issue your loan agreement, and once it is signed, you will have the funds in your business bank account within 24 hours.

We also offer customized loan payments according to your wishes, not ours. You can opt for monthly Interest Only payments, or we can capitalise the first 6 months of interest into the loan.. This means you don’t pay a cent for up to SIX months. This takes so much pressure off your cashflow.

- Get fast funding from $20,000 to $2,000,000

- Loan Terms from 1 month to as long as you like

- Complete the online application within minutes

- No penalties or additional charges for early loan repayment, or if you wish to extend the loan

Why try HomeSec for your urgent business loan?

We are Open Minded, and We Listen. We fund businesses of all sizes, and we will fund your business in 24 hours for any worthwhile business purpose. We don’t judge, and we take the time to listen to our customers. We are a trusted financial institution with a reputation for transparency and honesty. We follow responsible financial practices and work with businesses to meet their needs.

Got Bad Credit? Unlike conventional bad credit loans in Australia, we have eliminated all the hidden fees, complicated paperwork, and other fine print. We are one of the only bad credit business lenders who doesn’t increase the interest rate based on your credit risk. Credit scores, simply do not worry us.

We are renowned for funding easy loans for bad credit, as we look at things differently than all other business lenders. We look at factors like borrowers’ exit strategy (which means, how you plan to repay the loan at the end of the loan term), the loan term required, and equity available in real estate. Unlike other lenders, we look for ways TO fund you. We don’t look for ways to decline you.

Besides this, there are many other reasons that make HomeSec the perfect fit for your business, such as:

Fast and flexible business loans

Get funds in 24 hours. Repay early and save, or extend the loan for as long as you like.

Simple and hassle-free online application

You can apply for a loan by filling out a simple application form on our website, and let us handle the rest of the process.

Transparent charges and pricing

We have no hidden fees or charges, and we don’t ever offer fake low interest rates, which often come with monthly fees.

Fastest approvals

Get approved over the phone, and receive funding within 24 hours.

Get in touch with our financial experts anytime and have all your questions answered without any obligation.

OUR SHORT TERM BUSINESS LOANS ARE THE SOLUTION FOR…

Whatever the need, we can fund it

Urgent Injection of Cash

Borrow from $20,000 to $2,000,000 for any worthwhile business or commercial investment purpose. Loan terms are from 1 month to as long as you like, and we can genuinely have the funds in your account by the very next business day.

An Advance on a Refinance

Your bank is refinancing your home or other property, and they say it will take 2 to 3 months. But you need the funds from the refinance right away for your business. This is where a Business Bridging Loan from HomeSec saves the day. We bridge the gap until your refinance is funded.

Business About to Fail

Nothing is worse than not having any options left when a business needs an urgent lifeline to stay afloat and turn things around. Most lenders won’t fund loans when a business is in this situation, but HomeSec Business Finance will.

Business Opportunity

A once-in-a-lifetime business opportunity comes up, and it’s the first in with the cash who gets it. What happens if you don’t have the cash in your bank account? Who can get you the funds to secure the opportunity by tomorrow? HomeSec Business Finance can!

Property Purchase in Rescission

You’ve purchased a property, and the finance is all in place. Then, at the last minute, you find that your loan has been withdrawn, and you may now lose the property and your deposit. HomeSec can fund the transaction in just 24 hours, allowing you to finalise the purchase and find alternative long-term funding.

Tax Debts Paid

We all know that the ATO won’t wait around any longer for tax debts to be paid, but we also know that most lenders run a mile when they see an overdue tax debt. Not Us! We can pay the ATO and any other overdue debts by the next business day.

Why HomeSec Business Finance?

100% client focused

We specialise in giving business owners the funding they need to grow their businesses or save them from a crisis. Every client is treated like a friend, and friends don’t let one another down. This is what sets us apart from other lenders.

Trusted Business Lender

HomeSec Business Finance is all about speed, honesty and transparency. That’s why so many businesses have trusted HomeSec Business Finance in their time of need since 2004. Australia’s Fastest and Most Flexible Business Loans.

Clear & Upfront Pricing

Some private business lenders like to lure clients in with a cheap interest rate, but the interest rate is only part of the story. We pride ourselves on open, honest and transparent pricing, without the usual tricks that other lenders play.

Australia’s Fastest and Most Flexible Business Loans

The speed and convenience of Australia’s fastest business loans often come with a slight premium. We are here to help with a no-nonsense fast solution. We aren’t here to mess you about with deceptive and phoney cheap rates, as a lot of other lenders do.

Frequently Asked Questions

How do I apply for a loan?

Click on any of the apply now buttons on our website, or https://www.homesec.com.au/apply-express/

Is there a minimum loan amount?

Our minimum loan amount is $20,000

How long will it take for my loan application to be approved?

Applications can be approved and funded in as little as 24 hours.

How is the interest rate calculated?

Interest is calculated monthly and can be capitalised into the total loan amount.

What kind of security is needed for my loan?

We require equity in a real estate asset, this can be a residential property, commercial property or vacant land.